32+ mortgage interest tax write off

25900 for married couples filing jointly. Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up.

When Is Mortgage Interest Tax Deductible

Ad Learn How Simple Filing Taxes Can Be.

. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web For tax years 2018 to 2025 the standard deduction has been increased to 12000 for singles and married filing separately. Web Most homeowners can deduct all of their mortgage interest.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect. Discover How HR Block Makes It Easier to File Your Way. File Online or In-Person Today.

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web First know that theres a cap.

Discover Helpful Information And Resources On Taxes From AARP. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Web If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary homeup to 750000 if. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Also you can deduct the points.

Web The standard deduction for the 2022 tax year is. Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage. To deduct taxes or interest on Schedule A Form 1040 Itemized Deductions you generally must be legally obligated to pay the expense and must have.

16 2017 then its tax-deductible on mortgages. The deduction only covers the first million dollars of your mortgage interest. You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to.

Start Today to File Your Return with HR Block. You cant deduct the principal the borrowed money youre paying back. Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec.

Web If youve closed on a mortgage on or after Jan. Ad Fill Sign Email IRS 1098 More Fillable Forms Register and Subscribe Now. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Since you may be. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web The IRS lets you deduct your mortgage interest but only if you itemize deductions.

Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now. 18000 for heads of household. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million.

12950 for single filers and married individuals filing separately. Meaning if your home is more than 1000000 you will not be able. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Homeowners who bought houses before. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

Mortgage Interest Deduction Bankrate

M0q2ltuuwbbn5m

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction How It Calculate Tax Savings

Oct 13 At Home In Berks By Christian D Malesic Mba Cae Cmp Iom Issuu

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Ex 99d1g004 Jpg

Cash Out Refinancing What Is It Rates Pros And Cons Vs Home Equity Loan 2021 Cain Mortgage Team

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

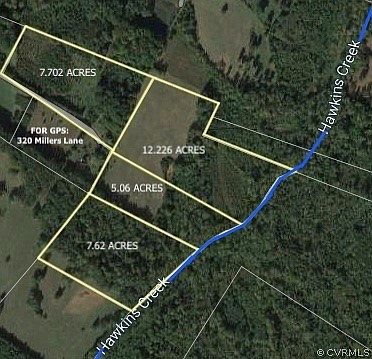

0 Millers Ln Bumpass Va 23024 Zillow

12 Business Expenses Worksheet In Pdf Doc

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Is The Interest On Your Mortgage Tax Deductible In Canada Loans Canada